Things To Know About MICR Code

What Is MICR Code

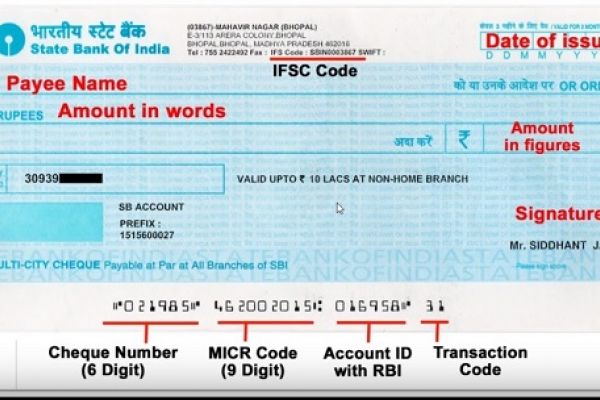

MICR stands for Magnetic link character recognition code. The MICR codes are used by the banking industry in order to make processing and clearance of the cheques and also the other documents. The MICR Codes usually lies at the bottom of the cheque. MICR Code is easily readable by human beings.

How Is It Used?

The ink that is used in MICR codes is magnetizable ink that usually contains the iron oxide.

Step 1: The document is first passed through the MICR reader and hen the ink gets magnetized.

Step 2: Then, characters passed over the MICR reader head. The characters that passed produces the waveform and that will be easily detected by the system.

The Character still can be read easily even though something overprinted in the Code. When the cheque is inserted, the machine easily found out the bank that the cheque belongs to and then the cheques will be sorted. Then the sorted cheques will move towards the centralized clearinghouse in order to determine the customer's account that gets charged and the branches that the cheque must be transferred. In some banks, the cheques are scanned digitally for stora

Here are the top benefits of the MICR codes

Security

All we need is high security, especially in the banking process. The MICR code plays a vital role in providing high security. The iron oxide link and the format in the MICR character make the document difficult to forge.

MICR Standards

In terms of printing, printing the MICR documents is a challenging one and it is not that much easy to achieve the standards. The MICR printing standards are maintained by the American National Standards Institute. The MICR Codes should meet American National Standards Institute requirements. If it does not meet the requirements the cheque will be rejected.

Fewer Errors

When compared to other recognition systems, the error rate that happens in MICR codes are very less. The MICR readers easily decipher the characters as per the standards set out by the American Bankers Association (ABA) and the American National Standards Institute (ANSI). For instance, if 30,000 checks are processed, only one read error will be there. This is because there is no manual input that creates huge errors. The MICR Information can be easily read with a high level of accuracy. The MICR information processing is accurate and quick.

Conclusion

These are the important things that you need to know about MICR codes. If you are in India, the indian bank details provide you with all IFSC code, MICR code and addresses of the bank branches in India